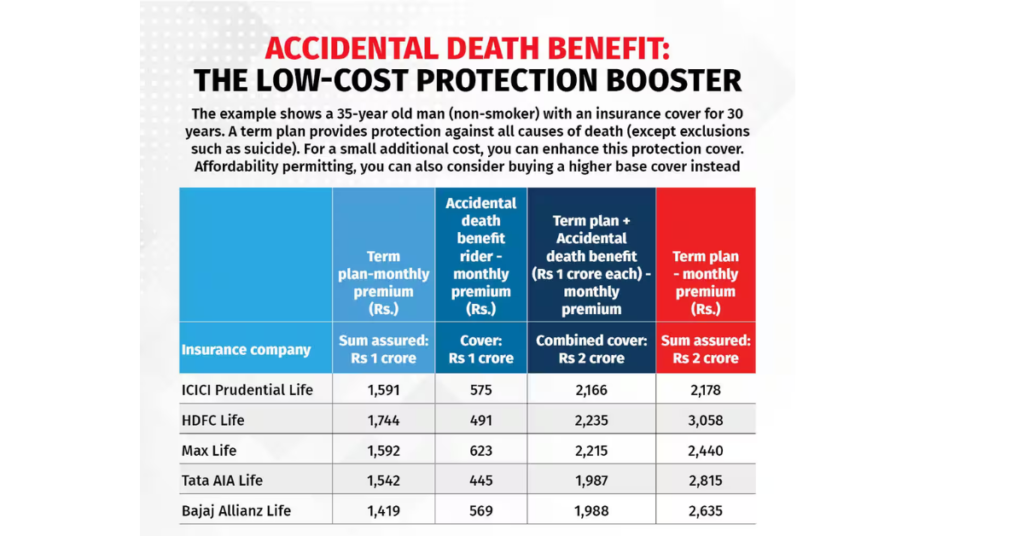

For stronger protection at minimal additional expense, you can top off your base term plan with an accidental death benefit rider. Although this rider is not a replacement for a full-term plan, it might be a cheap option to increase your life insurance coverage.

A life insurance policy (term plan) is a must-have to ensure that your family is financially secure in the case of your death.

However, in addition to a term plan (base cover), you can choose a rider—an additional feature added on top of the base cover—to make your life insurance more complete.

Certain riders, like as the critical illness rider, come at a high cost and thus require a cost-benefit analysis before you choose them. An accidental death benefit (ADB) rider, on the other hand, is a relatively low-cost option that provides additional protection.

“It is simple to obtain an accidental death benefit rider.” It does not necessitate any complicated documentation or formalities. “All you have to do is fill out an application form,” Sanjay Arora, Executive Vice President and Head of Operations at Tata AIA Life Insurance, adds. After all, unlike serious illnesses, there are no pre-existing ailments that must be disclosed.

Some businesses sell accidental death and disability insurance as a single rider, whilst others sell both policies separately. The combined accidental death and disability benefit (ADDB) rider is the most advantageous purchase, affordably speaking. An ADDB rider offers compensation for lost wages owing to total and permanent disability brought on by an accident, whereas a simple ADB rider only pays out the claim amount in the event of death.

If the death was brought about by something other than an accident, the insurer only pays out the base plan’s promised sum.

Assume you have a term plan with a Rs 1 crore base cover and a Rs 1 crore ADB rider. The policyholder’s nominee will then be paid Rs 2 crore in the event of accidental death, and Rs 1 crore in the event of death due to other causes.

Professor Manoj K Pandey, a faculty member at Birla Institute of Management Technology and a life insurance industry veteran, points out that an ADB rider can be added to a variety of ULIPs, endowment plans, and other products.

ADB riders are not permitted to exceed base coverage.

So, what exactly is “accidental death,” and how much coverage can you get under this rider? Accidental deaths include those caused by vehicle or other road accidents, aviation crashes, falls, fires, or firearms. Deaths caused by suicide or self-inflicted injuries, parachuting, participation in dangerous sports, and so on are not included.

Your ADB rider amount cannot be greater than your base plan coverage. If you have a term plan with a base sum assured of Rs 1 crore, you can only get a crore in ADB coverage.

But how much protection should you take? “An ADB rider comes at a very low additional premium, so you should take the maximum possible cover,” advises Rishabh Garg, Head of Term Insurance at Policybazaar.com.

If you already have a term plan with an amount insured of Rs 1 crore, he estimates that the cost of an additional Rs 1 crore of insurance will be 80–90 percent of the first Rs 1 crore. However, with an ADB rider, the additional cost could be as little as 25–30%.

Of course, with the latter, you are only covered if the death is the result of an accident.

ADB rider or a higher base cover

So, which is better: a bigger base sum assured or an ADB rider? Here are the opinions of specialists.

“As the term implies, a rider ‘rides’ on a base policy. The sum promised under the rider may not be greater than the sum assured under the base policy. As a result, the base policy should have the greatest feasible life insurance coverage. “This (base policy) protects against death from any cause, including illness, old age, or accident,” explains Pandey.

An accidental rider acts as a supplement to the benefit if the rider dies in an accident. “This is the simplest rider to obtain, with almost no underwriting required, except for those with deformities, etc.” “The premium is also quite low,” he add.

Kapil Mehta, co-founder and CEO of SecureNow Insurance Brokers, agrees. “If you can afford it, taking a higher sum assured under the base plan is the best option.” According to Mehta, “the accidental death benefit can be viewed as a cost-effective way of increasing your sum assured.”

Garg recommends that when making this decision, one should consider one’s lifestyle. “If you frequently use two-wheelers or public transportation, such as shared autos, which expose your life to greater risk than, say, driving, you should consider taking this rider.” It should be noted, however, that the compensation is not limited to car accidents. A death caused by a fall at home will also be considered an accident.

While the ADB rider is not a replacement for full-fledged life insurance, it is a nice complement for greater protection, especially given its low cost and ease of use.