Mutual funds Riskometer: Consider the thrill of a white-water rafting trip and the rush of adrenaline as you race up the waves to your destination. However, before embarking on the adventure, a responsible tour guide typically informs participants about potential hazards and safety precautions. He or she also ensures that everyone has a life jacket and is aware of the necessary survival skills.

Investing in mutual funds is similar in that it is critical to understand the risks involved as well as the mitigation processes in order to navigate through them. The Riskometer can be one of the most useful tools for investors on this journey, allowing them to make more informed decisions. Mutual funds Riskometer

Riskometer History

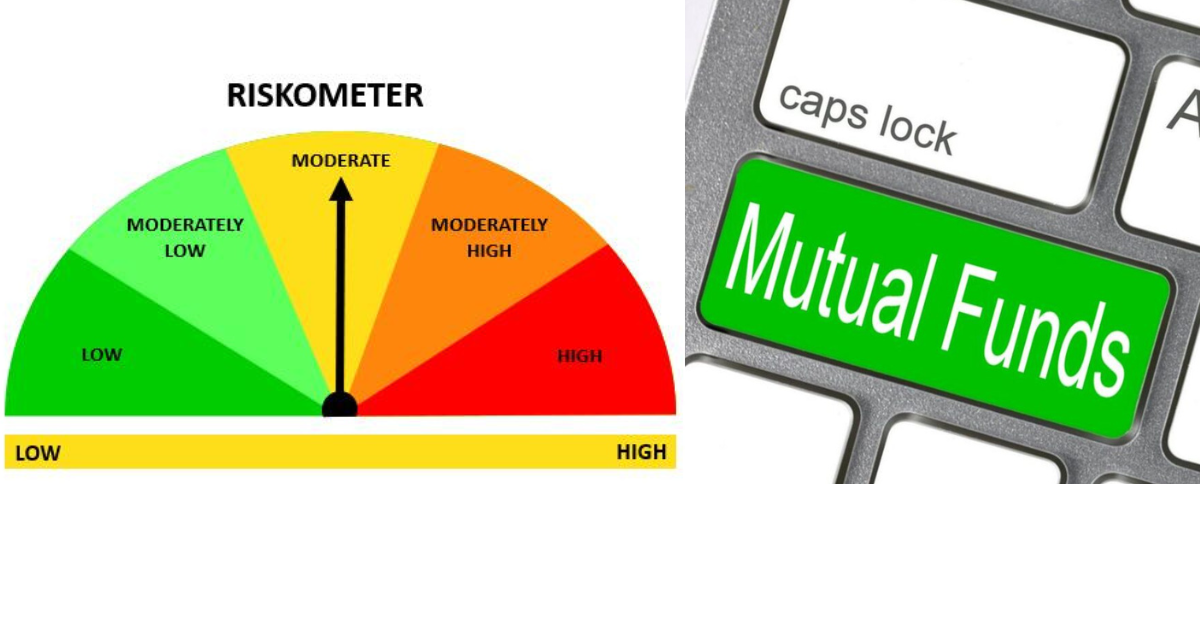

When you open a scheme-related document, one of the first things you’ll notice is a semicircle with an arrow pointing towards the fund’s ‘Risk’ levels. SEBI introduced the ‘Riskometer’ in 2015 as a risk benchmark in the given scheme. Previously, fund houses would color code risk as low, medium, or high risk using blue, yellow, and brown codes.

However, the riskometer introduced at the time did not account for the granular risks associated with mutual fund schemes. As a result, SEBI refined it further to identify and categorize risk as low, low to moderate, moderate, moderately high, high, and very high risk based on their individual categories.

The master circular calculated risk based on a fund’s actual underlying holdings, taking into account market capitalization, volatility, and liquidity in the riskometer. It has proven to be effective on both the equity and debt sides over the years, promoting transparency among investors. – Mutual funds Riskometer

Recognizing the riskometer

The riskometer is a standardized tool used by mutual fund houses to communicate individual fund risk levels. It provides a visual representation of a fund’s risk profile by using a needle (similar to a compass needle) to represent different risk levels:

Low Risk

Investors who invest in ‘Low Risk’ funds can expect their principal to be subject to Low Risk. This category of investments is appropriate for investors who want to take minimal investment risks.

Moderately Low Risk

Investors who invest in funds classified as ‘Low to Moderate Risk’ can expect their principal to be exposed to little market risk. This category is appropriate for cautious investors.

Moderately Risk

‘Moderate Risk’ funds, as the name implies, are appropriate for semi-conservative investors willing to take limited risks with their invested capital in order to create wealth.

Moderate high Risk

Schemes in this category are typically exposed to equity-oriented risk on the invested principal. These are appropriate for aggressive investors with a medium to long-term investment horizon (3 years or more).

High Risk

‘High Risk’ schemes are appropriate for aggressive investors willing to invest for the long term (>5 years). The principal invested in these schemes is subject to high risk and increased market volatility.

Very High Risk

These funds primarily invest in equity with a higher relative risk profile than other funds’ highly volatile stocks. It is appropriate for very aggressive investors. With the goal of long-term wealth creation, the invested principal is subjected to the highest risk in the mutual fund spectrum. Funds in this category include sectoral/thematic/international/midcap/small funds.

From the perspective of an investor

The Riskometer serves as a useful guide for investors, assisting them in understanding the risks associated with mutual fund investing. Investors can make informed decisions and effectively manage risks by becoming familiar with the Riskometer’s categories and aligning them with their comfort levels, goals, and investment durations.

For example, gilt funds and ultra short-term funds with maturities of less than 90 days are typically assigned a low-risk rating. Because these funds have a low risk-to-return benefit, they may be suitable for risk-averse investors looking for a steady income stream with low-risk, low-return growth.

From the standpoint of an investor

The Riskometer serves as a helpful guide for investors, assisting them in understanding the risks associated with mutual fund investing. Investors can make informed decisions and effectively manage risks to meet their financial goals by becoming familiar with the Riskometer’s categories and aligning them with their comfort levels, goals, and investment durations.

For example, gilt funds and ultra short-term funds with maturities of less than 90 days are typically assigned a low-risk rating. These funds may be suitable for risk-averse investors seeking a steady income stream with low-risk, low-return growth due to their relatively low risk-to-return benefit.

Investors with a higher risk tolerance, who are willing to wait patiently and stay invested in the market for the long term, may consider investing in high-risk funds for long-term goals such as retirement or a child’s higher education.

Those planning for goals such as travel or lifestyle upgrades should consider moderately high-risk funds, as these funds generally invest in companies with large market capitalization or multi-cap funds, allowing them to choose between large-cap, mid-cap, or small-cap companies. Moderate-risk funds offer substantial opportunities for medium- to long-term investing, and they are appropriate for investors willing to commit to a two- to three-year investment period, seeking moderate profits while accepting a low level of risk.

Finally, the Indian mutual fund industry has transformed dynamically in recent years, aided by the integration of technology and the rapid growth of digital channels. The reality of this industry today is far beyond what anyone could have imagined when it first took root in India nearly 30 years ago! A large part of this phenomenal growth can be attributed to the regulator’s meticulous risk control mechanisms to protect investors’ best interests.