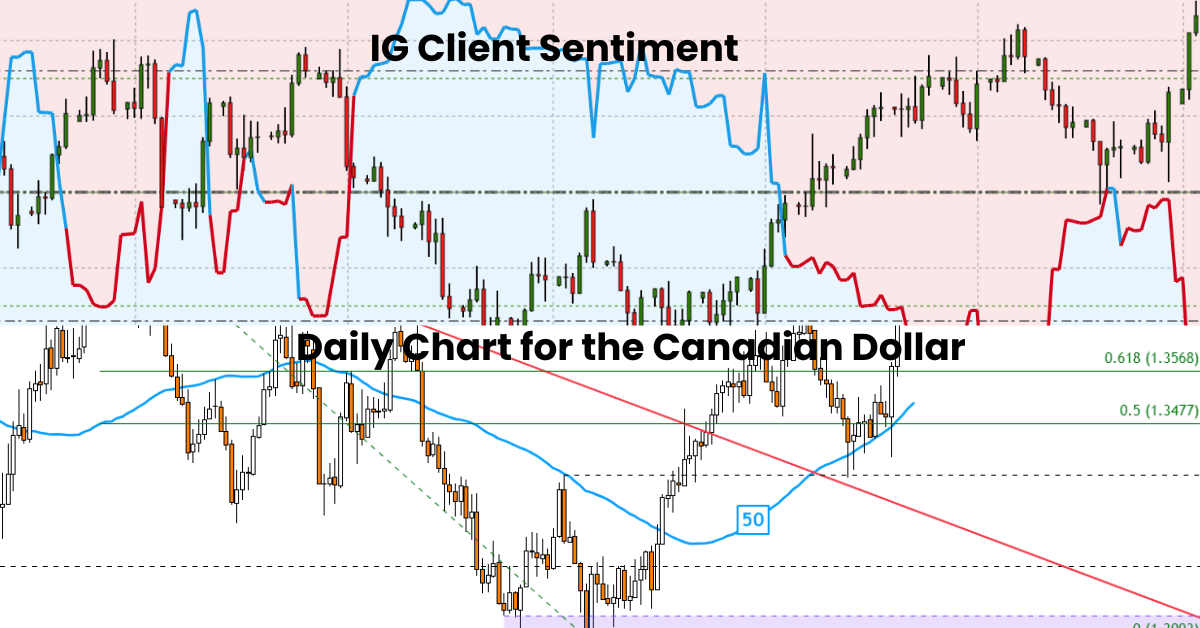

TECHNICAL ANALYSIS: With USD/CAD up approximately 1.8 percent thus far, the Canadian Dollar is approaching its worst 2-week stretch against the US Dollar since mid-February. In response, retail traders have increased their downside exposure, as can be observed by looking at IG Client Sentiment (IGCS). This last one frequently serves as a contrarian indicator. Will USD/CAD move higher from here keeping that in mind? – TECHNICAL ANALYSIS

Bullish sentiment outlook for USD/CAD

Only approximately 27% of retail traders are net-long USD/CAD, according to the IGCS indicator. This means that prices may continue to decline in the future because the majority of them are inclined downward. This is because, compared to yesterday and last week, the downside exposure increased by 1.77% and 29.04%, respectively. In light of this, a greater optimistic prognosis is presented by the interaction of recent developments and overall exposure.

Daily Chart for the Canadian Dollar

The USD/CAD has verified a breakout over the crucial 1.3668 inflection zone on the daily chart below. The latter started earlier this year, in or around April. The currency rate is trying to decrease going into Thursday’s European trading session. Recent advances have coincided with a downward RSI divergence.

This indicates that upward momentum is waning, which might occasionally signal a shift lower. The 50-day Moving Average continued to act as support in September, keeping the overall upward focus intact. In the event of a severe downturn, it very well could occur once more. The 61.8% Fibonacci retracement level of 1.3568 would then come into focus. If not, moving higher focuses attention on the March high of 1.3862.