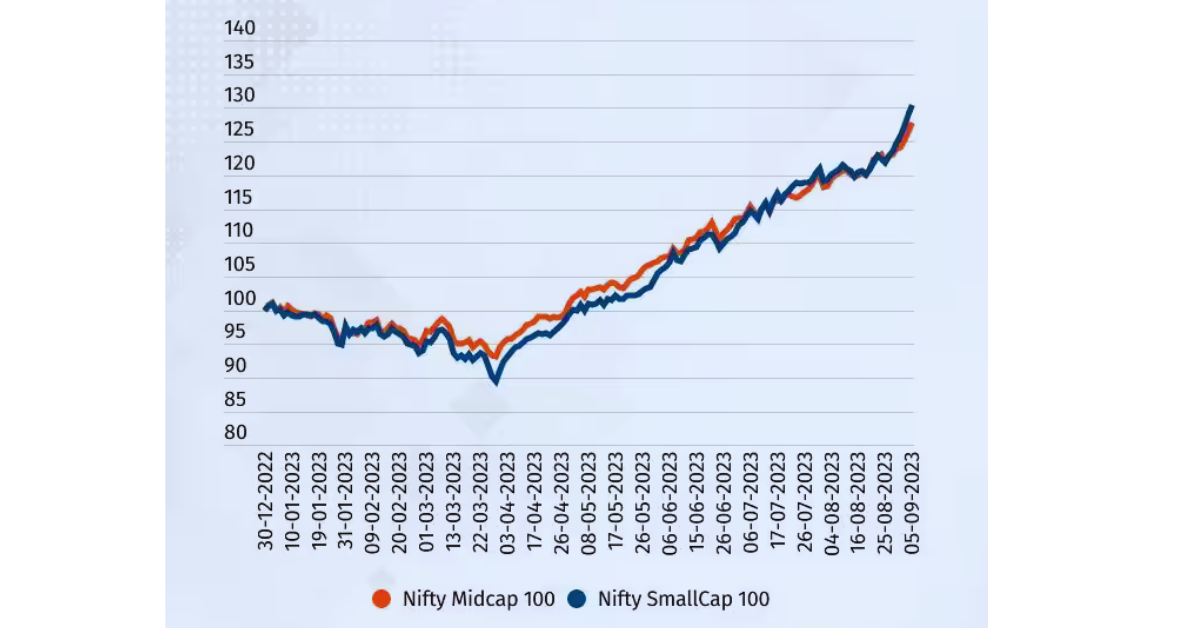

The Nifty MidCap 100 index rose in 13 of 15 sessions, while the Nifty SmallCap index rose in 12 of 15 days. The indices increased by 6% and 8.4% throughout this period, respectively, and have increased by 27% and 30% this year.

Despite analyst fears, the bull run in mid-cap and small-cap stocks appears to be far from over, with the Nifty Midcap 100 index breaking through the 40,000 mark for the first time and the Nifty SmallCap index setting a new all-time high on September 5.

The Nifty MidCap 100 index increased in 13 of the 15 sessions, while the Nifty SmallCap index increased in 12 of the 15 days. During this time frame, the indices increased by 6% and 8.4%, respectively, and are up 27% and 30% so far this year.

Bulls in the small-cap and mid-cap space seem to have braved the caution sounded out by several brokerages over higher valuations. Nirmal Bang Equities CEO Rahul Arora suggests that the market is facing a shortage of attractive investment opportunities as many decent stocks have been bought up and are no longer available at lower prices. As a result, investors are crafting stories for stocks they wouldn’t typically consider, leading to previously overlooked stocks suddenly becoming expensive.

In an interview with Business Line, Nilesh Shah, Managing Director of Kotak Mahindra AMC, warned that investors should be cautious in the small-cap and mid-cap space because there have been a lot of bubbles built up. While large-cap stocks are trading near their historical valuations, this will be justified when the economy grows and earnings upgrades become a reality.