Wall Street Week Ahead: “In the past, it has frequently been advantageous for investors to buy American stocks after the Federal Reserve ends its cycle of rate hikes. This time, though, things look different since the economic outlook is uncertain and prices seem inflated.

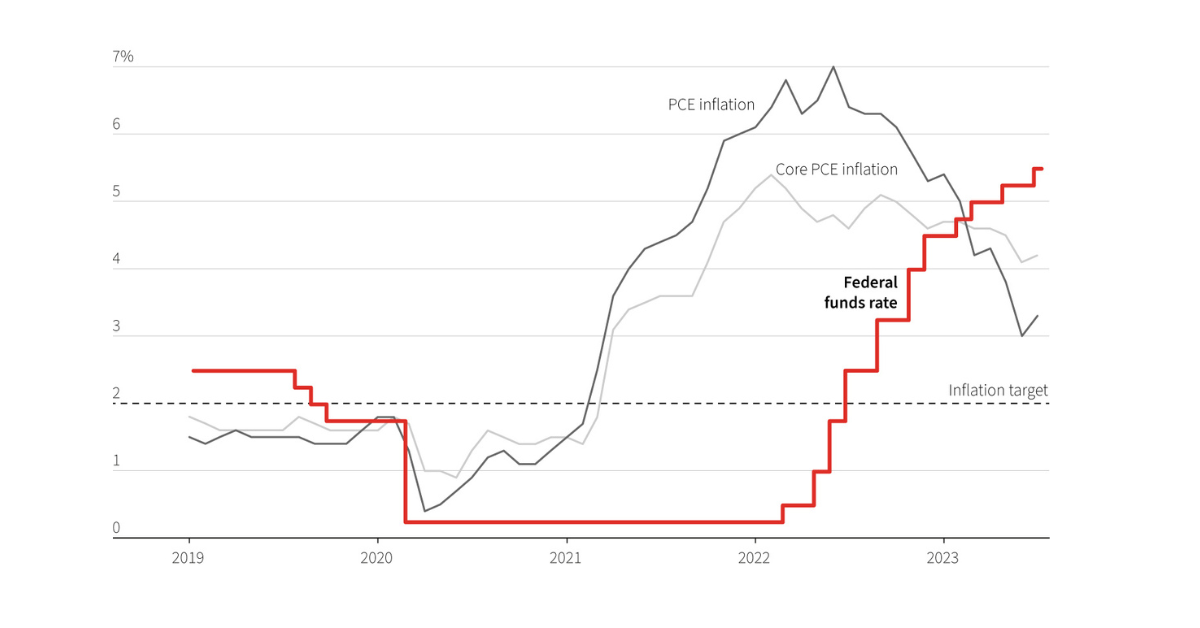

Despite raising borrowing costs by 525 basis points since March 2022, many believe that the U.S. central bank would leave interest rates steady when its meeting is over the following week. Investors generally do not anticipate more rate increases by the policymakers as they anticipate the central bank to end its most aggressive monetary policy tightening cycle in decades.

If they are correct, equities may be ready for further increases. According to an analysis by financial research firm CFRA, the S&P 500 (.SPX) increased on average 13% from the final rate hike to the first cut in the subsequent cycle during the Fed’s previous six cycles of credit tightening.- Wall Street Week Ahead

However, those who hold a more bearish outlook believe that a downturn will soon come as tighter economic circumstances result from rising rates. The U.S. economy has held strong in the face of increasing interest rates, contributing to the S&P 500’s nearly 16% gain so far this year.

According to Brent Schutte, chief investment officer of Northwestern Mutual Wealth Management Company, “The market will probably cheer it a little bit if it is the end of the Fed rate hike cycle.”

But according to Schutte, whose firm prefers fixed income over equities, “I don’t think the economy is going to stay out of a recession and that is going to be what ultimately determines the direction of stocks.”

Although the majority of investors think a recession in 2023 is unlikely, some market participants still see a slowdown in 2024 as a possibility. The inverted Treasury yield curve, a financial phenomenon that has previously occurred before recessions, has been one unsettling recession warning indicator.

The CME FedWatch Tool, which tracks bets on futures linked to the central bank’s policy rate, predicts that the Fed will hold rates unchanged 97% of the time when it releases its policy statement on Wednesday. According to the statistics from CME, traders believe that the Fed will hold interest rates steady in November nearly two out of three times.

HIGH RATES

While pledging to proceed cautiously at upcoming meetings, Fed Chair Jerome Powell stated last month that the central bank may need to hike rates further to decelerate inflation.

However, if the inflation readings continue to be as largely benign as they have been over the past few months, it may be that the July quarter-point hike by the Fed was the last in a cycle that rattled asset values last year.

Sam Stovall, chief financial strategist at CFRA, said that if Wall Street believes that the Fed has stopped tightening interest rates, “that would at least offer support if not give (stocks) an additional catalyst to keep working higher.”

Additionally, investors are trying to predict when the Fed will start loosening monetary policy. The S&P 500 gained an average of 6.5% in the six months after a rate decrease, according to CFRA research, which found that the Fed typically cuts rates nine months after its previous rate increase.

According to the CME statistics, investors are forecasting a slight likelihood of a cut as early as the Fed’s meeting in January, with estimates of a cut for May at roughly 35%.

Even if the Fed stops raising interest rates, some investors still foresee difficulties for the stock market.

Oxford and other investors are leery of the skyrocketing stock prices this year. According to LSEG Datastream, the S&P 500 is currently trading at roughly 19 times ahead of 12-month earnings forecasts, up from 17 times at the beginning of the year and its long-term average of 15.6 times.

The increase in bond yields, which has raised the appeal of fixed income as a stock alternative, is also a danger to equity prices. The 10-year Treasury yield is nearly at over 15-year highs.

Jack Ablin, chief investment officer at Cresset Capital, said: “If (the Fed) came out and said ‘we’re done,’ yeah, I do think that is probably cause for some celebration.” I’m not convinced, though, if it would be sustainable given where equities are currently valued in relation to bonds.